The owner’s policy has five sections: covered risks, the exclusions from coverage, Schedule A, Schedule B and the conditions. Click here for a pdf.

1. Covered Risks

This section lists what kinds of risks the policy insures against. However, the policy makes it clear that the insurance of the listed risks are subject to (1) the Exclusions listed following the Covered Risks, (2) any exceptions listed in Schedule B, and (3) the Conditions. In the most current ALTA Owner’s policy, there are ten covered risks listed in the policy. Some of the most important covered risks are:

- the risk that someone else owns your property

- that there is some defect or encumbrance on your title caused by fraud or forgery

- any liens for real estate taxes or assessments that are due but unpaid

- that your title is unmarketable, that is, you are unable to sell your property to a purchaser because of a title defect

- right of access to and from your land.

Review your owner’s policy or ask your title agent about the covered risks included in your policy.

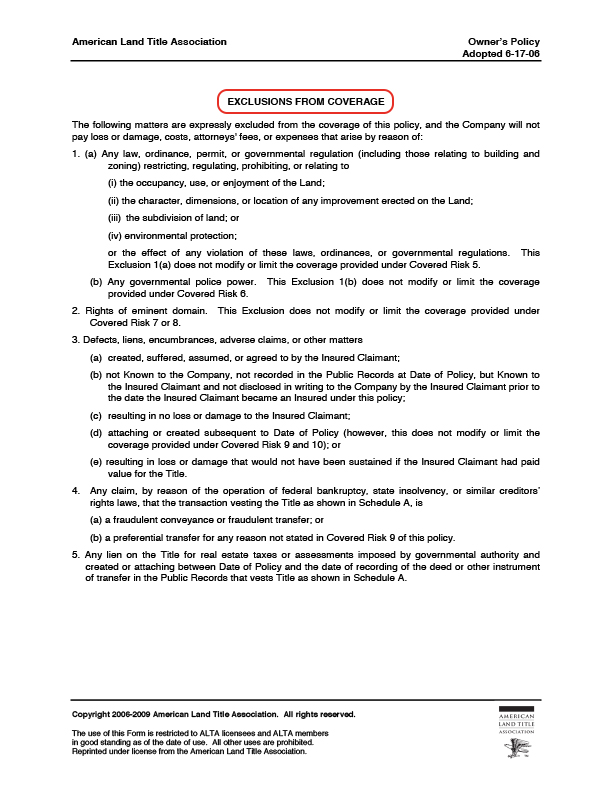

2. Exclusions

Exclusions limit the coverage of the policy. They deal with issues that are outside the control of the title company. The ALTA owner’s policy contains five exclusions, which include matters such as governmental regulations on the land and eminent domain, as well as title matters created or agreed to by the insured, or title defects known to the insured but not disclosed in writing to the title company prior to the date of the policy. The policy does not insure against any defect or title issue that is created or attaches to the property after the date of the policy. Also, the policy does not insure against the effects of bankruptcy law on the transaction creating the insured interest.

3. Schedule A

Schedule A sets forth the specific information on the title and policy, such as the date of policy, the amount of insurance, the insured, the legal description of the land insured by the policy and the estate insured, such as fee simple or leasehold. Schedule A must be attached to the policy in order for the policy to be valid.

4. Schedule B

Schedule B lists the various exceptions to the title that the title company found when it performed its title search. Common exceptions would be things such as prior unreleased mortgages on the property, easements, taxes, restrictions on the use of the property, and any other limitations on the title such as homestead rights or survey issues if no survey has been performed. By listing various items as exceptions, the title company is telling the insured that these items are not covered by the title policy, and that the title company will not pay a claim or defend against a claim based on these excepted items.

5. Conditions

This section outlines the relationship between the insured and the title company. Paragraph 1 contains the definitions of certain terms used in the policy. Terms such as “Insured,” “Insured Claimant,” “Knowledge” and “Public Records” are defined so as to eliminate any ambiguity. There are several different paragraphs setting out how a claim under the policy is handled, including how to provide notice of a claim, what is required to prove loss, and the requirement that the insured must cooperate with the title company in the handling of the claim. Click here to learn how to file a claim. The Conditions describe the rights of the title company to pay or settle the claim, and the determination, extent and limitation of liability. Most policies also contain a paragraph that allows the insured or the title company to demand arbitration if the amount is under $2 million.