At least three days before your closing, you should receive a Closing Disclosure, which is a five-page document that gives you more details about your loan, its key terms, and how much you are paying in fees and other costs to get your mortgage and buy your home.

Many of the costs you pay at closing are set by the decisions you made when you were shopping for a mortgage. Charges shown under “services you can shop for” may increase at closing, but generally by no more than 10 percent of the costs listed on your final Loan Estimate.

Here is a look at the general contents of each page of the Closing Disclosure.

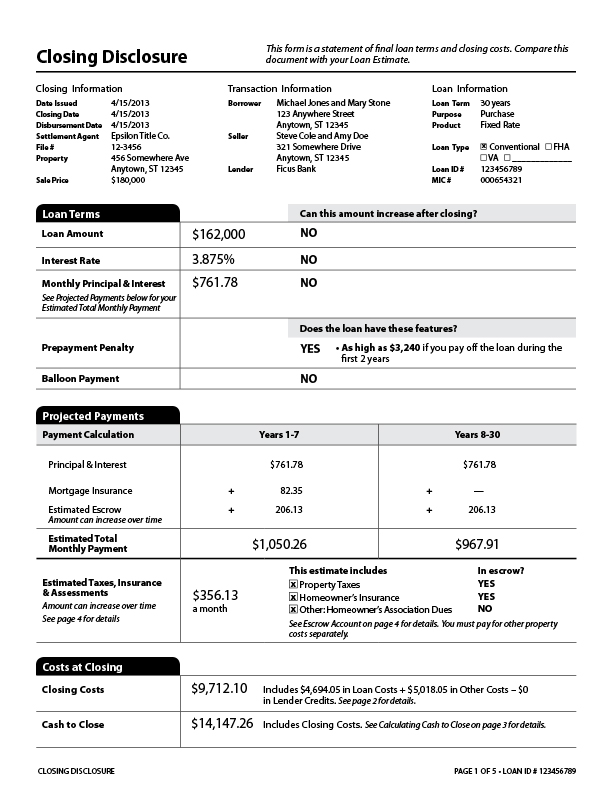

- Page 1: Information, loan terms, projected payments costs at closing

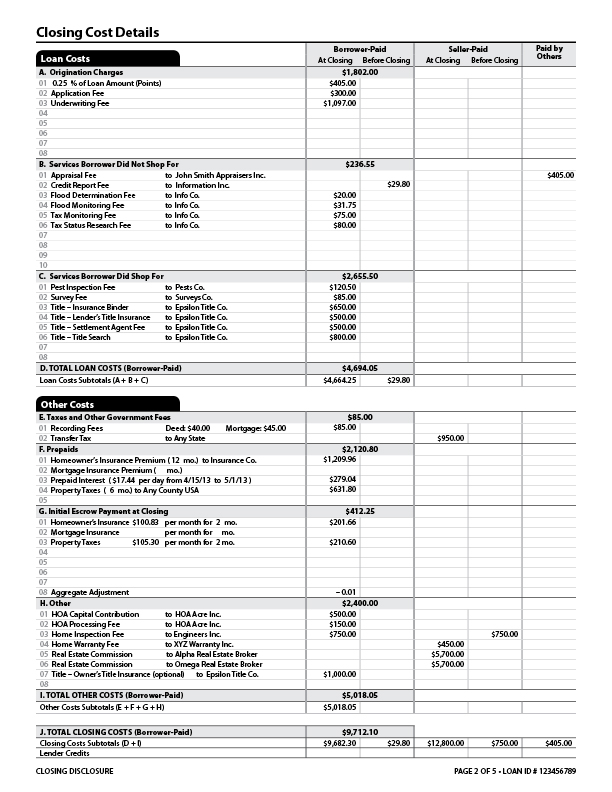

- Page 2: Closing cost details including loan costs and other costs

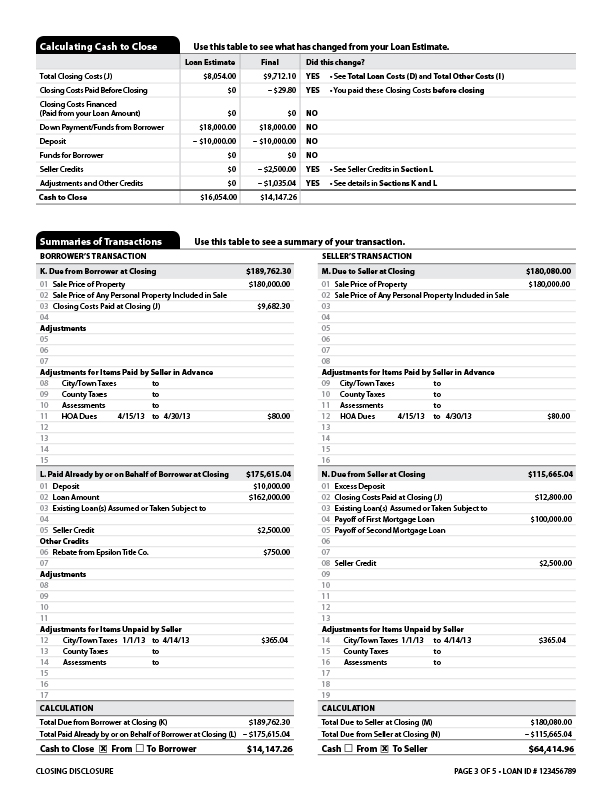

- Page 3: Cash needed to close and a summary of the transaction

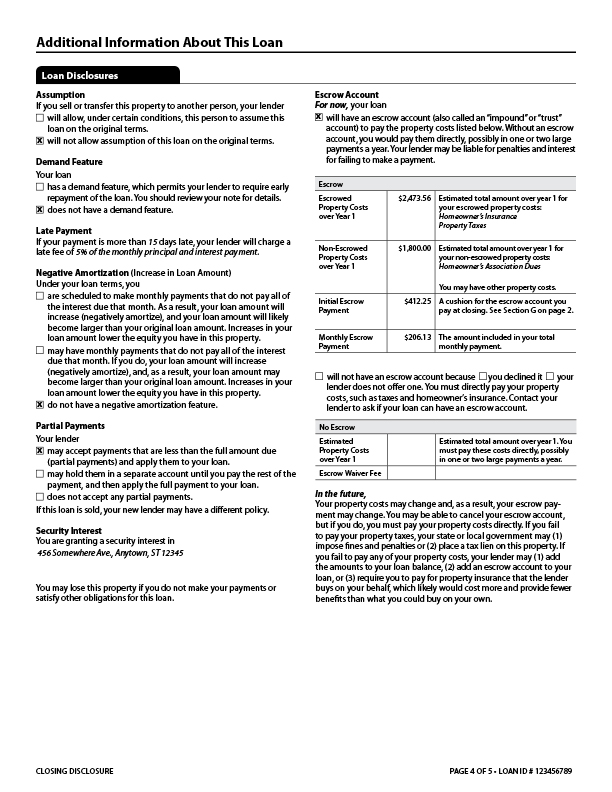

- Page 4: Additional information about your loan

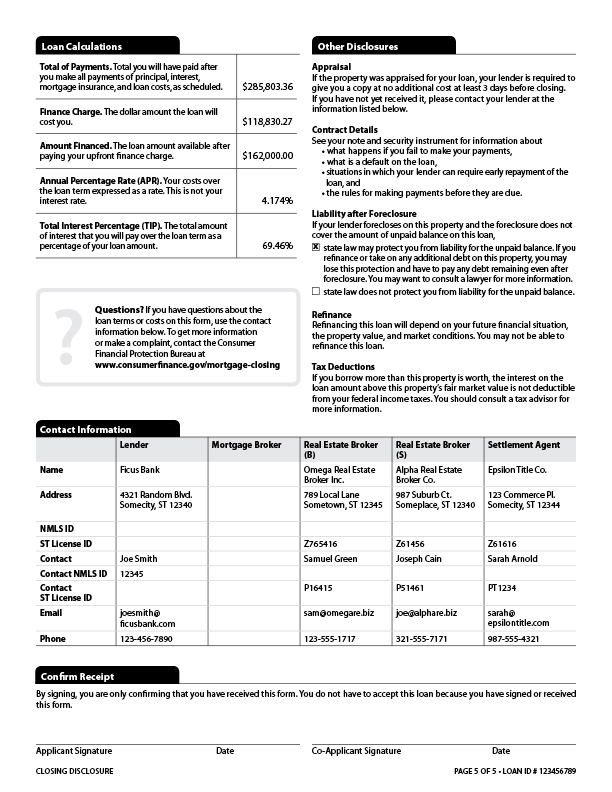

- Page 5: Loan calculations, disclosure information and contact information